Consumers as well as retail professionals turn out to be confused about price dynamics in FMCG. A lot of people are not aware of regional price differences and possible online and offline price differences. BrainTower asked 75 retail professionals (25 retailers and 50 manufacturers) as well as 375 consumers about pricing related topics. A limited sample, but the results do hint at a certain information gap, not only within the industry but also at the consumer side.

Online & offline create confusion

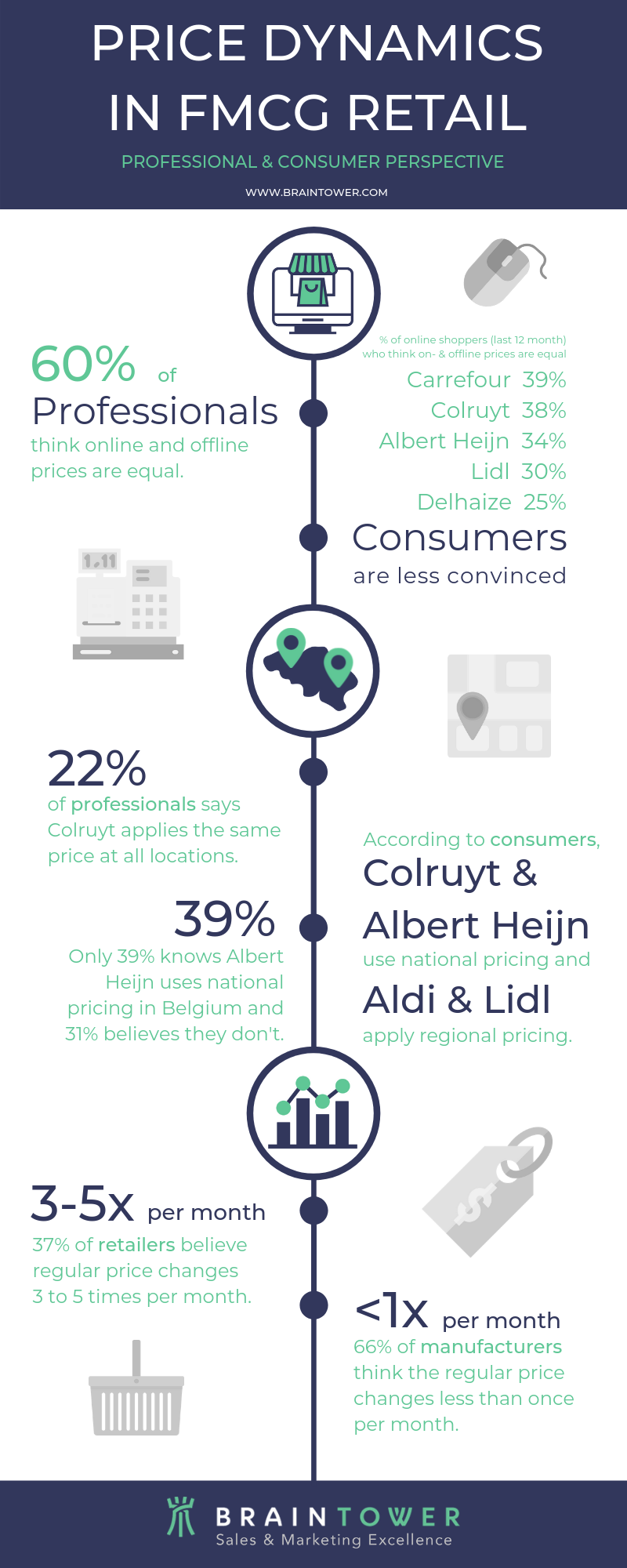

A large part of retail professionals think online and offline prices are equal. This is true in large part but, as recent news items and an analysis by retail data specialist Daltix proved, not for Collect&Go/Colruyt. Online shoppers are less convinced about online/offline price equality. However, this is the fact for each retailer we asked about, so do they really know? Apparently not since 22%-48%, depending on retailers, indicating they don’t know whether online and offline prices are the same.

Regional pricing still has many secrets

It’s amazing that 22% of retail professionals who participated in the research think Colruyt applies the same price at all locations. While the topic of regional pricing at Colruyt was covered on national television only recently. What’s more, 31% believes Albert Heijn applies regional prices, also not true. Most consumers say Colruyt and Albert Heijn use national pricing while believing Aldi and Lidl apply regional pricing. We have to disappoint them, 3 out of 4 are wrong.

A different take on the FMCG market dynamics.

Asked about the frequency of (standard) price changes, answers of retailers and manufacturers couldn’t be more apart. Most retailers participating in the survey believe prices to change 3 to 5 times per month. However, manufacturers estimate the price of their products changes only once per month. This visual by Daltix proves who’s closer to reality.

Information gap

The infograph below sum’s it up. On both sides, retail professional as well as consumer, there’s a lot of confusion. Even between retailers and manufacturers an information gap about price dynamics exists. With quite some room for improvement, these indicative results show the need for solid, reliable and fast data in a market that’s becoming ever more dynamic.

Contact us for more information on the research.

We can also help you cope with the challenges in the dynamic FMCG market.

Take a look at our Expertises.